New York ATM Strategy – Sweep-Based Reversal Model

Overview

Important Note: This strategy represents the foundational entry model of my broader trading system. While the New York ATM approach captures key sweep-based reversal setups, I frame my trades using additional confluences including higher-timeframe bias (1H/4H market structure), significant liquidity pools (equal highs/lows, session highs/lows, unfilled imbalances, trendline liquidity), as well as institutional tools like VWAP, moving averages, and stochastic divergences.

I am currently working toward integrating these advanced elements into the automated bot version of this strategy. Due to my limited programming knowledge, this is a gradual development process, but this page presents the essential reversal logic that underpins my discretionary and systemized trading approach.

The New York ATM Model is a structured intraday strategy designed to capture algorithmic stop-hunts and reversals during the New York session open. It focuses on liquidity sweeps of either Buy-Side or Sell-Side followed by confirmation using Fair Value Gaps (FVGs).

This model is executed between 9:30 AM and 11.00AM EST on lower timeframes, but it reflects a higher-timeframe algorithmic behavior pattern. It is currently being enhanced to incorporate higher-timeframe bias, VWAP alignment, and moving average confluence for more precision.

Strategy Logic

- Mark the high (BSL) and low (SSL) between 7.00 am to 9.29 am EST.

- Wait for a sweep of either BSL or SSL: indicating liquidity grab.

- Detect a valid Fair Value Gap (FVG) in the opposite direction.

- Enter only after a confirmed close through the FVG.

- Set stop-loss at post-sweep high/low and target opposite liquidity level.

Key Concepts

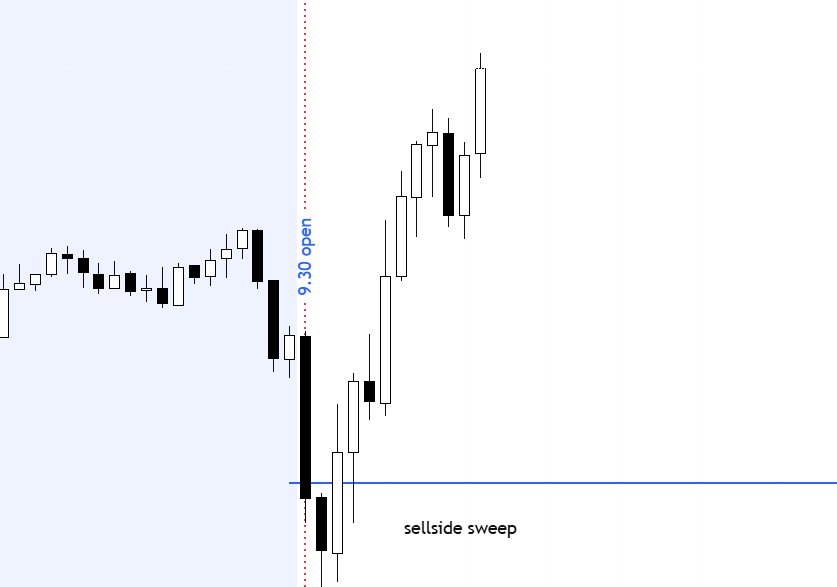

Buy-Side & Sell-Side Liquidity (BSL & SSL)

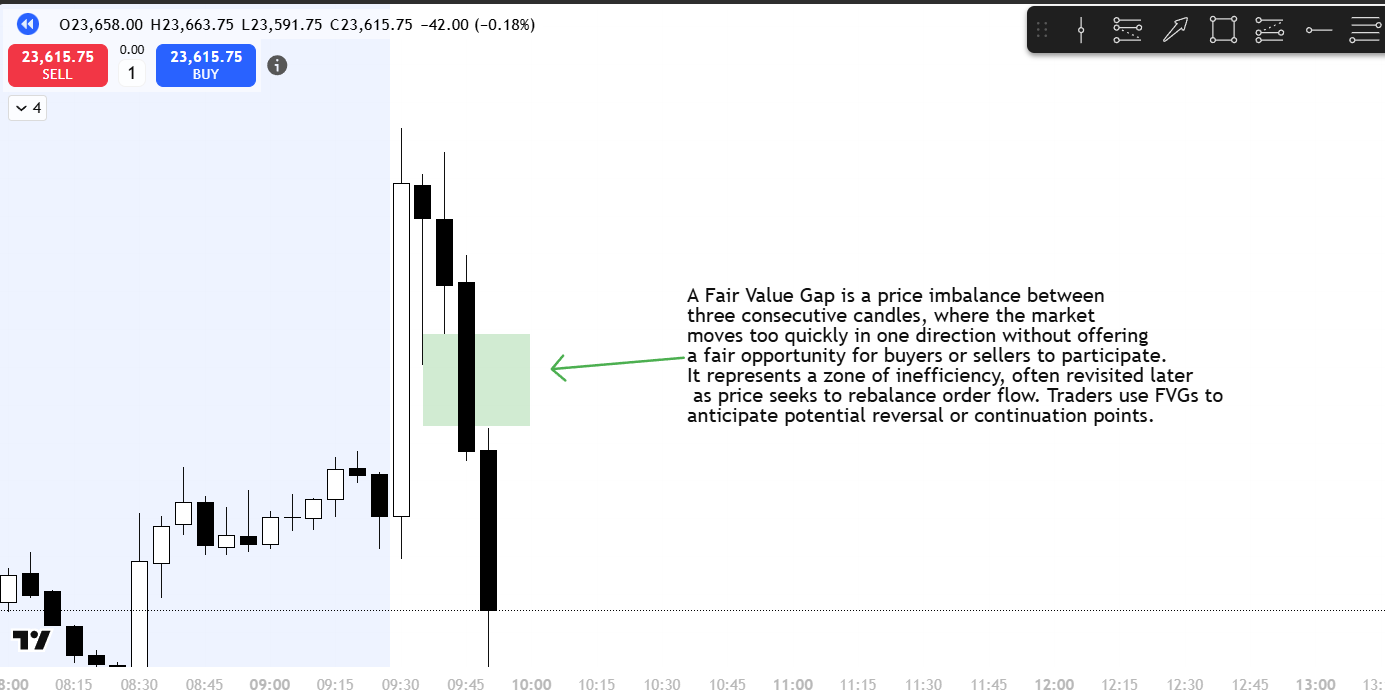

Fair Value Gap (FVG)

Trade Example: Reversal Entry Breakdown

1. Liquidity Sweep (Trap Setup)

The first condition for this setup is a sweep of either Buy-Side or Sell-Side Liquidity. This occurs when price breaks above the session high (BSL) or below the session low (SSL), triggering stops. This move is often used by institutions to trap retail traders and fill larger orders in the opposite direction.

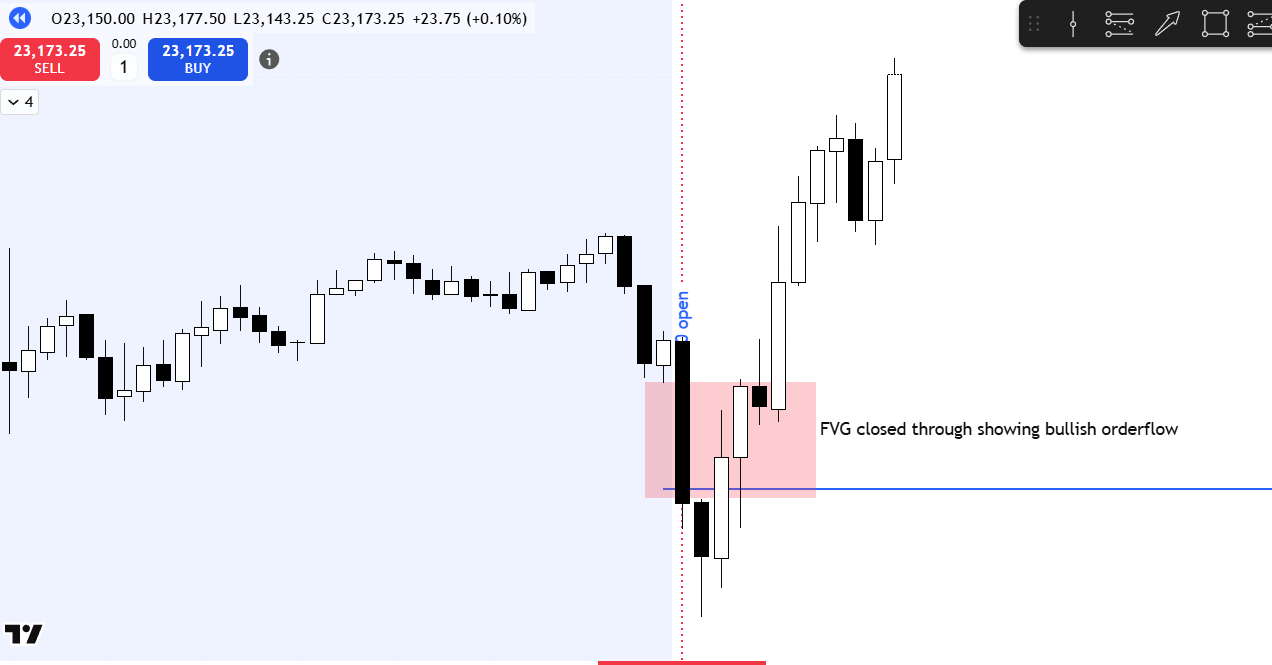

2. Fair Value Gap Break (Order Flow Shift)

After the sweep, price must form and close through an opposing Fair Value Gap (FVG). This break signals a shift in order flow from expansion in the direction of the sweep to a reversal back inside the range. This is the primary confirmation that the sweep was a trap and not a breakout.

3. Entry and Target

Once the FVG break is confirmed, the model waits for the very next candle to execute the trade. Stop-loss is placed at the high or low created during the sweep. The target is the opposite liquidity level,for example: if SSL was swept, the trade will target the previous BSL. This provides a clean and mechanical framework for directional bias, risk, and reward.

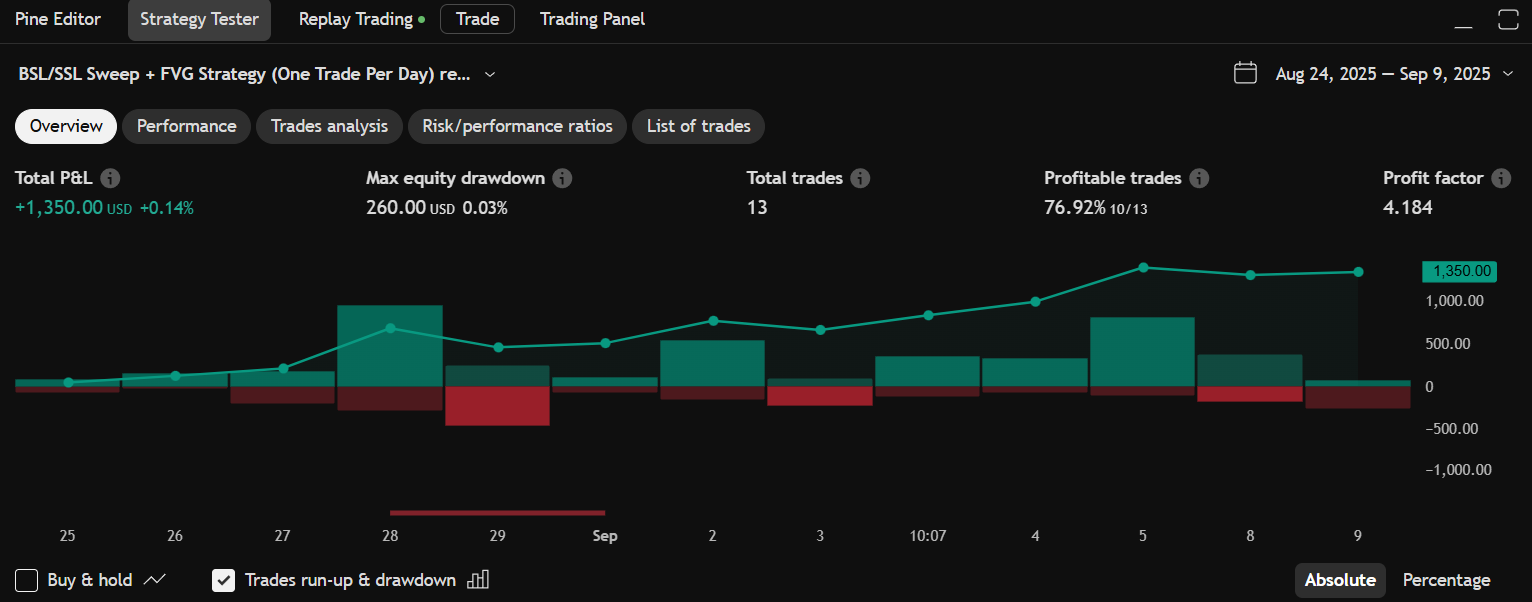

Backtest Performance

Period: August 24 – September 9, 2025

- Total Trades: 13

- Win Rate: 76.92%

- Net P&L: +$1,350

- Max Drawdown: $260

- Profit Factor: 4.18

Ongoing Enhancements

This version of the strategy is intentionally simple, using only liquidity and FVG structure. Upcoming features include:

- Higher-Timeframe bias (1H / 4H structure filters)

- VWAP and Moving Average confluence

- Improved exit logic with scaling and dynamic RR

Technology

- Platform: TradingView

- Language: Pine Script (v5)

- Execution: Semi-automated backtesting, one trade per day

- Source: View Script